In personal finance, time is more than a four-letter word; it’s the simplest and most reliable tool we have for building wealth. How much more money you’d have for retirement

When Bankrate asked Americans about their biggest financial regrets, not saving early for retirement topped the list.

It may sound premature to squirrel away money for retirement in your 20s (or even earlier) – hey, it’s decades away – but a few years could make a difference of tens of thousands of dollars, or more, thanks to compound interest.

Compound interest is a form of exponential growth that rewards savers and investors, particularly those who act early. It’s the snowball effect: As you roll a snowball down a hill, it gathers more snow. Not only does the original snowball grow in size, but each additional pack also grows.

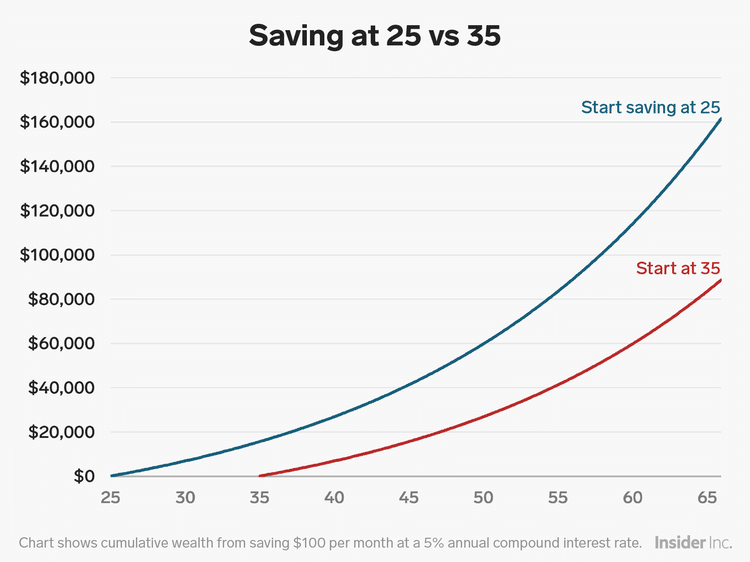

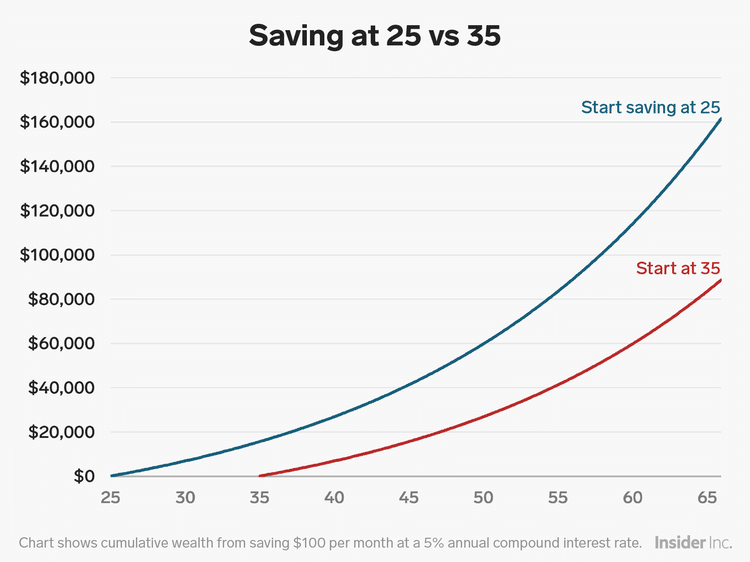

Consider the following example and the chart below. Chris and Jennifer both invest $100 a month at a 5% annual compound rate of return. Chris begins investing at age 25, putting away $100 every month until 65 and Jennifer begins saving $100 a month at age 35.

An extra 10 years of saving means that Chris has about $162,000 in his bank account, while Jennifer has $89,000 by the time she is 65. Chris’ balance is nearly double Jennifer’s, and he contributed only $12,000 more of his own money.

Now, if Chris and Jennifer incrementally increase their monthly contribution as they grow older – perhaps bumping up their savings rate by a small percentage with every pay raise – they’ll wind up with even more money in that account at retirement.

Plus, investing in the stock market, whether directly or through a retirement account such as a 401(k), may yield a rate of return that’s even higher than 5% in some years. Historically, the stock market has averaged a 7% rate of return, adjusting for inflation.

Saving in a tax-advantaged retirement account, such as an IRA or 401(k), can give your money an even greater boost. Those types of accounts are funded with pretax money, so your full dollar will have the opportunity to compound.