.

Having a good credit score is an important part of most people’s lives. It lets lenders know how responsible you are when borrowing money. This can be something small like a personal loan or a big financial commitment like a getting a mortgage. Yet, in 2020, most people still have no idea how their credit score works. Here are some things to keep in mind next time you think about your credit score.

Know What Goes into Your Credit Report

This is your first line of defense — Knowing what information goes into your credit report can give you an idea of your financial health; you can also verify if you’ve been the victim of identity theft. The three main credit reporting agencies (Equifax, Experian, and TransUnion) can

provide you with a copy of your credit report once a year. Due to the current COVID-19 pandemic, all three credit reporting agencies are now

offering free weekly online reports through April 2021; this is your first step. Next, you have to find out what information goes into your credit report and what factors can improve or damage it. Finally, ask how can you improve your score. Usually, that information is provided to you as a list of risk factors — Always ask for your risk factors!

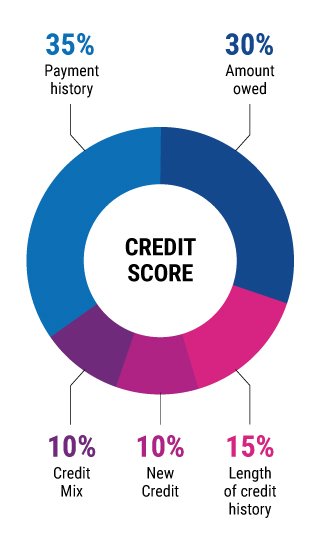

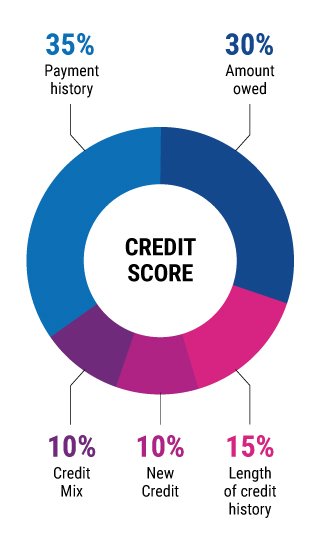

Know What Makes Up Your Credit Score

Your credit score is composed of five categories: your payment history (35%), the amounts you owe (30%), the length of your credit history (15%), your credit mix (10%), and new credit (10%). Changes to any one of these categories can change your score, so maintaining a good score entails making payments on time, not owing too much, having a good balance of different kinds of debt (mortgages, credit cards, installment loans, etc.), opening new credit lines, and not using too much of your available credit.

Some less serious factors that can lower a credit score include not having a long credit history or having a high credit utilization. For example, someone who only has one or two years of payment history may not have a high score simply because there isn’t enough information for the lender to decide whether they are creditworthy. Another example is someone who has three credit cards with a $30,000 total credit limit between the cards. If they only carry a debt of $5,000 on those cards their credit score will be higher than if they carry a debt of $25,000.

Other factors that reduce a credit score, however, are much more serious and can have a longer-lasting effect on your ability to obtain new credit.

Negative Impacts on Your Credit Score

The following behaviors will not only lower your credit score and cause trouble in your financial life, but they will also stay on your credit report for up to seven years in most cases, significantly impacting your ability to obtain new credit or qualify for lower interest rates:

- Late Payments or Non-payment: Payment history accounts for a large chunk of your credit score, so if you are chronically late or not paying at all, it will hurt your score significantly. It also signals lenders that you cannot afford, or are unwilling, to pay your debts. According to Equifax, a single late payment that is overdue by 30 days can cause a point drop in some cases.

- Having a charge-off: A charge-off happens when a creditor has given up on you ever paying your debt and they “charge off” your account. This could cause a credit score drop of 100 points or more in some cases.

- Bankruptcy: Bankruptcy is an extreme measure and will hurt your credit score by up to 200 points or more. It also stays on your record for seven to ten years, depending on the type of bankruptcy.

- Foreclosure: A foreclosure is another red mark on your credit that can cause a credit score to drop substantially. FICO reports that a credit score can see up to a 100 point drop from a foreclosure, depending on the consumer’s starting score.

- Repossessions: If your car is repossessed, the credit bureaus may include a note about the repossession in your credit reports that stays for up to seven years. A repo can include many of the negative line items you see here, such as late or non-payment, so the score drop can easily go over 100 points.

- Judgments: A judgment comes when a court is forced to get involved to ensure debt repayment. Credit score impacts can vary but the drop could also be over 100 points.

- Collections: A collection occurs when a creditor resorts to hiring an outside firm to collect payment. Collections fall under payment history, so the hit to your credit score can also be over 100 points.

Get a Free Copy of Your Credit Report

You are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion. You can obtain a copy of your free credit report in one of the following ways:

- Online: AnnualCreditReport.com

- Phone: (877) 322-8228

- Mail: Download and complete the request form from AnnualCreditReport.com. Mail the completed form to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

You can also obtain your credit report through the major reporting agencies themselves. You can also sign up for one of these companies’ monitoring services, which include unlimited access to your report.

Equifax: Though this company made headlines in 2017 for a massive data breach, it remains one of the top 3 services to get your credit report. The company provides a few different levels of service if you want to monitor your credit score monthly (as opposed to getting a free, yearly report). Monitoring packages start at $14.95 per month, and the $19.95 per month options (there are two) include, ironically, a host of identity-theft protection options.

Experian: Experian offers a free 30 day trial period before charging you $21.95 a month for the monitoring service. With that fee, you get identity-theft protections, fraud-resolution services, and monitoring of your credit score at the big three companies.

TransUnion: For $24.95 a month, TransUnion will monitor your credit scores from all three reporting bureaus in real-time; alert you if someone applies for credit using your name, and features personalized debt coaching services.

Smart Credit: Trade Guardian has a credit monitoring service for $18.99 per month with a 30 day free trial. This includes all three bureau reports once a month, a money manager which will sync with all your accounts to give advice on which to pay down first to increase your score, fraud alerts, direct negative item disputing to the credit bureaus, and $1 million dollars in identity theft insurance. This is amazing compared to its competitors all starting at $21.99 and higher. In addition, Trade Guardian will offer a free credit assessment for joining.

Clear Negative Items From Your Credit Report

Keep in mind that if the negative item in your report is accurate and timely, there is nothing you or anyone else can do to remove it. “The Federal Trade Commission has said that you cannot remove accurate negative information prior to the time frame specified in the law,” says Griffin. These negative items will remain in your report for seven years, although in some cases there may be state laws that will reduce that term. Check your state laws to see what the time limits are on information placed in credit reports.

If you do find inaccurate or fraudulent information in your report that is driving your credit score down, you have several avenues you can pursue to get that information removed that don’t require spending money. As Griffin says, “Absolutely do it yourself for free.”

Dispute the Information With The Credit Bureau

The Fair Credit Reporting Act (FRCA) requires creditors to report accurate information about each account, so if any entries are incorrect on your credit report, the bureaus are required to investigate and make the appropriate corrections. It’s important to note that you’ll need to dispute the entry with each of the credit bureaus to make sure the removal is complete across the board.

Disputes can be initiated with any one of the credit bureaus through their websites or by mail. When initiating a dispute, it’s important to have documentation and to be clear about what information you are disputing. The credit bureau will then contact the source of the erroneous information and dispute it on your behalf.

Credit reporting bureaus will also provide support if you are the victim of identity theft or fraud. Options they can provide include freezing your credit so no new accounts can be opened in your name or including a fraud alert in your report to alert lenders accessing your information that you are a victim of fraud.

Initiate a Dispute Directly With the Reporting Business

If you decide to dispute a credit report entry directly with a business, which includes credit card issuers and banks, the business is also required to investigate and respond. If the reporting business corrects the issue, you might just save yourself a step. It is important to make sure the items are cleaned up for all three credit bureaus mentioned above.

If you’re worried that trying to work out your debt directly with the lender may somehow reset the clock on the amount of time a negative item will remain on your report, relax. The seven-year retention period starts counting on the date the account was first reported late or unpaid and does not change if you initiate negotiations to pay down the debt.

Hire A Professional Credit Repair Service

When looking at the lifetime cost of bad credit, or if your report is riddled with inaccuracies, paying $99 a month for a reputable company like Trade Guardian to help repair your credit is often a reasonable solution. Credit repair services can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Creditor negotiations

Keep in mind that these actions are ones you can handle on your own. However, if your credit repair is complicated, credit repair services might be right for you.

Top Rated Credit Repair and Debt Negotiation Companies

Any of these companies below come highly recommended. Board certified, licensed, bonded, and insured ensuring each advisor is current with credit repair standard, Fair Credit Reporting Laws (FCRA), Fair Debt Collection Practices (FDCPA), and the most effective credit repair strategies to date.

Article Provided By Our Friends at Money.com

Other Articles Readers Enjoyed: