Timeshares Accounts To The Death Of Good Credit

Another day where I am listening to a customer who bought a timeshare with a couple of thousand dollars down and financed the remaining $20,000. During this conversation, I am cringing in preparation for what I am about to disclose to this unfortunate timeshare owner.

“Sir, I am about to share some news that is going to upset you very much. I am just apologizing now….the timeshare resort is not going to refund you any money you put towards the mortgage or down payment. We can stop the bleeding of your bank account that is what we are talking about now.”

The client begins to yell and the rising tone and anger are heard through the handset of my desk phone. I look over to my fellow consultant who automatically knows I just dropped the no return on investment bomb.

After I go over the steps of enrolling in our timeshare cancellation program and share the steps of our strategy the timeshare owner is prepared to move forward and take a step in the right direction.

The timeshare developers are not in business to give out refunds no matter how much you scream and kick your feet. If they have it’s gone. But we do have alternative actions we can attempt. One typical strategy is to dispute any charges with your bank or credit card company for services not delivered as promised or stated. This dispute process has fairly positive results earning a 60% success rate of refunds.

So we all know that refunds from the timeshare company aren’t happening what is the next step. We need to stop the bleeding. Meaning the monthly payment that is draining your account. The one you hate paying and wished it would just go away.

Well, I have good news. Timeshare accounts are typically financed in house and any third-party financing at a transfer of account data. Any bit of information that is passed to another person or company has the risk of being lost, sent in error, and in many cases not complete.

Knowing the receiver of this information is not fully informed or will mishandle this data is all in benefit to you, the timeshare owner.

When it comes to timeshare accounts and especially ones financed a true assessment needs to be conducted and a monitoring plan should be in place.

As a credit and risk management firm we identify accounts, contracts, public records, identity verification, general personal data, vehicle history, CLUE reports, LexisNexis reports, Experian, TransUnion, Equifax, Innovis, and criminal/civil records that are risky or hold a level of measurable risk. We will then develop and deliver a strategy to reduce or eliminate the risk.

Key factors initially identified and even some of these you can do yourself. Is the timeshare account on your credit report? What is the status of the account? Does the account have inaccurate information?

Another investigation that needs to be conducted is for deeded timeshares only. Is there a public record of the deed? Is any of the information inaccurate?

The last do it yourself risk assessment is verifying if the account is on your LexisNexis report? Is any of it inaccurate?

If you are saying yes to these questions then you are in need of Trade Guardian. The items I listed ideally can be identified, investigated, disputed, corrected, deleted, and verified on your own. The only downside is the massive amount of time you will spend doing this and if you dispute any of these items incorrectly you will end up validating the account in question. This will add way more time for us to correct and will hurt our process greatly.

My best advice is to use an experienced credit and risk management firm to handle your timeshare accounts and not a credit repair firm that has a lot of YouTube videos.

We specialize in timeshare account removal and guarantee our results. Typically we have 73% account removal rate in the first 60-90 days. These are strong numbers for an industry that locks their clients in for life on contracts society deemed their permanent.

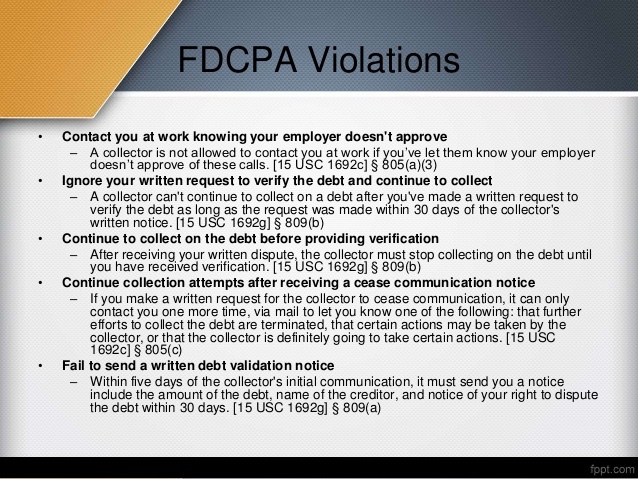

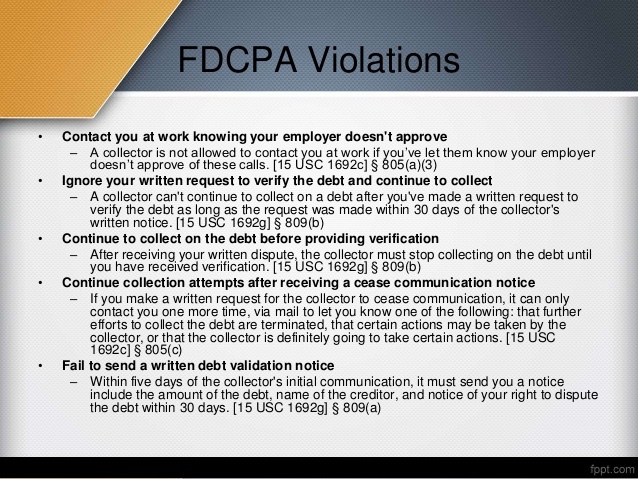

Our team of credit and risk managers has brought alternate industry experience to build strong strategies that perform. We involve all regulatory agencies as needed and call upon Federal Law violations to the forefront of the account removal process.

Don’t allow your credit to misshapen by a timeshare and the accounts that came along with it.

We provide a free credit assessment to identify the harmful accounts and will provide the timeline and cost to remove, repair, or change the timeshare account on your credit report, LexisNexis report, public records, and any other reporting platform out there.

It all starts with a call 407-807-0753